Accrue Real Estate's Observations on the State of the Melbourne Property Market

Listening to certain media reports of late, you’d swear the Melbourne property market is done for. Stick a fork in it and move on! Believing this, according to Accrue Real Estate, might just be one of the worst mistakes a property investor and / or allied industry professional could make.

Accrue Real Estate points to recent news accounts of how Melbourne has overtaken Sydney as the worst performing capital in terms of its declining property market. This label is based on an all-encompassing figure that includes all suburbs and all property types – ignoring the fact that Melbourne continues to show strong performance amongst certain locations and property types.

An Overview of Melbourne’s Property Market as a Whole

As Jeff Grochowski, Principal at Accrue Real Estate, states “Melbourne’s property market is going along pretty good. Sure there’s been a retraction after extraordinary growth over the last six years; however, there continues to be real standouts and opportunities. The overall picture being painted doesn’t tell the entire story.”

The retraction in the Melbourne property market, overall, is shown in CoreLogic’s Hedonic Home Value Index (as at 31st July 2018). That is,

-

Annually, Melbourne’s property prices fell by a gentle -0.5% over the past year

-

For the month of July, there was a drop of -0.9%

-

For the July quarter, there was a drop of -1.8%

-

The Melbourne market peaked in November 2017 and property prices have since decreased by 2.9%

Due to the three months to July quarter figure of -1.8% Melbourne has been dubbed the “weakest performing capital city”.

While Accrue Real Estate acknowledges these overall figures are a great tool to compare and contrast previous years and other capitals, the problem is that it overshadows numerous positive aspects of Melbourne’s property market – both historical and current.

Melbourne’s Property Market Continues to Grow for Investors

The below presents some of these positive aspects:

Melbourne’s Affordable End Outshone the Upper End

While Melbourne’s upper end of the property market has been hit the hardest, the most affordable continues to do well. As of 31st of July 2018, Melbourne saw annual property prices rise 7.5% at the affordable end, while at the upper end (top quartile) there were decreases of 4.1% (CoreLogic’s Hedonic Home Value Index).

Melbourne’s Growth Suburbs

Despite declines across the Melbourne property market as a whole, there’s been significant growth in numerous suburbs.

While some of the inner suburbs experienced declines, house prices rose in Melbourne’s northwest, northeast and outer east over the June 2018 quarter (Malo, 2018).

Examples include the top ten growth suburbs in Melbourne between the March to June quarters of 2018 which have seen median house price rises of between 15.90% to 5.80% and units between 46% to 12.90%. Included in these results are the suburbs of Brighton, Mornington, Keilor East (houses), Sandringham, Carlton and Glen Huntley (units).

In terms of median house price growth over the 12 months to April 2018, the top ten Melbourne suburbs experienced annual rises of between 50.4% and 31.9%. The top three suburbs include Research, Plenty and Coolaroo.

Differences in Growth between Houses and Units

The overall figure of decline in the Melbourne property market does not show the performance and price differentials between houses and units.

Overall, Melbourne units outperformed houses. The CoreLogic Hedonic Home Value Index (July 2018) found that Melbourne units increased by 2.3% annually and rose to a median of $569,141, while houses fell annually by -1.4% to a median of $813,064.

Price changes between the two quarters of March to June 2018 show that the top seven suburbs in unit price increases – that is, Sandringham, Carlton, Glen Huntly, St Kilda East, Abbotsford, Thornbury and South Yarra – outperformed the top suburb, Brighton, in terms of house price increases.

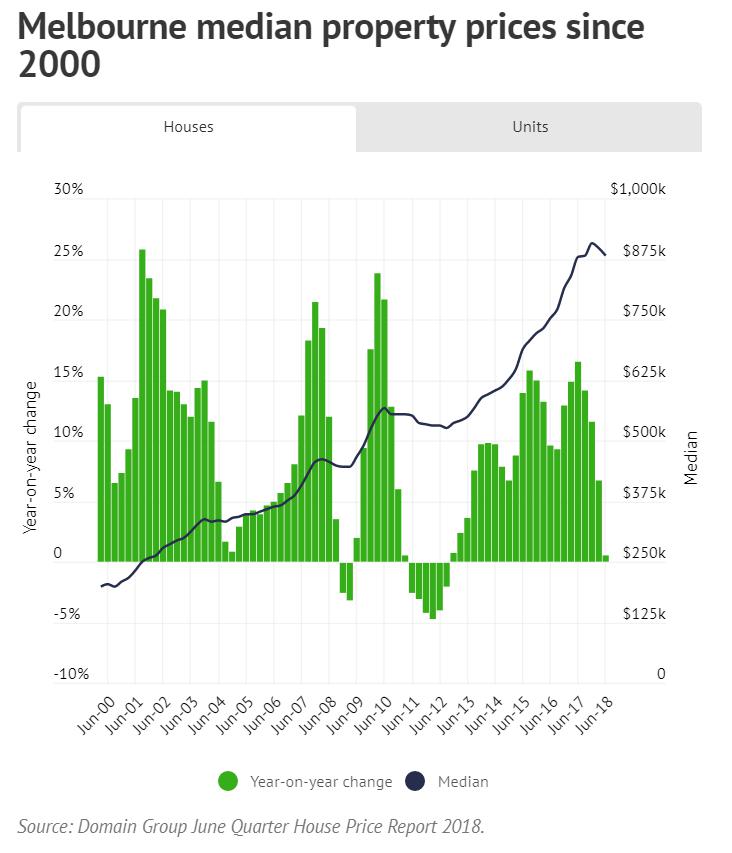

Melbourne’s Historical Price Increases: A Picture of Growth

Melbourne’s current property movements come off the back of significant increases over the last six years. The Domain Group March Quarter House Price Report shows that Melbourne prices have increased approximately 45% since 2012 (Bagshaw, 2018). A gentle fall in price still means substantial increases have been experienced by investors.

Taken from: Malo, 2018

Accrue Real Estate also points to a number of factors that makes Melbourne’s property market – now and into the future – a smart investment. Most obvious is the rapid population expansion and the need for housing. Some suggest the population is expected to bypass Sydney by 2030. Another factor that contributes to a strong property sector is that Melbourne is increasingly seen as a business investment alternative to Sydney (e.g. Amazon). This in turn brings increased investment and population.

The future looks bright for Melbourne’s Property Market

There’s no doubt that the tightening of investor credit has had an impact on Melbourne’s property market, with investors exiting the market and creating less demand.

Accrue Real Estate also attributes price increases at the affordable end of the property market to stamp duty concessions for first-time buyers (purchases under $750,000). This has meant increased demand for housing, pushing up entry level prices.

Jeff Grochowski, Principal at Accrue Real Estate, believes that overall Melbourne property prices will experience further gentle declines before settling. The market is moving along nicely and is far too strong to experience a collapse.

In terms of the future outlook for the Melbourne property market, Accrue Real Estate sees current positive growth trends and opportunities continuing for the informed investor.