To tackle inequality, we must start in the labour market

- Written by Jim Stanford, Economist and Director, Centre for Future Work, Australia Institute; Honorary Professor of Political Economy, University of Sydney

This article is the second in the Reclaiming the Fair Go series, a collaboration between The Conversation, the Sydney Democracy Network and the Sydney Peace Foundation to mark the awarding of the 2018 Sydney Peace Prize to Nobel laureate and economics professor Joseph Stiglitz. These articles reflect on the crisis caused by economic inequality and on how we can break the cycle of power and greed to enable all peoples and the planet to flourish. The Sydney Peace Prize will be presented on November 15 (tickets here).

Scientific understanding of the consequences of inequality has grown by leaps and bounds in recent years. Thanks to the pioneering work of scholars such as Joseph Stiglitz, Kate Pickett and Richard Wilkinson, and Tony Atkinson, we know that persistent social and economic inequality exacts an enormous toll: on mental and physical health, the stability and efficiency of communities, and macroeconomic performance.

Read more: The fair go is a fading dream, but don't write it off

How, then, should this pervasive and multidimensional problem best be tackled? Statistically, we can measure income inequality at three different levels. And those levels provide a natural categorisation of the policies needed to combat it.

First, inequality can be measured in incomes received before government steps into the picture. This “market income” includes wages and salaries, income from personal investments, profits and dividends from businesses, and other sources. Inequality is highest for market income, and has grown notably over the last generation.

Second, we measure inequality again after government has collected taxes and made transfer payments back to households. “Disposable income” thus reflects the cash redistribution arising from government fiscal and social policies. So long as income taxes are progressive and transfer programs (like unemployment benefits, child benefits and age pensions) are broadly accessible (or even targeted at lower-income households), inequality in disposable income is lower than for market income.

Finally, inequality in final living standards should consider the value of non-monetary public sector programs. Public services like education, health care, recreation and transportation do not put money into consumers’ pockets but they do enhance their standard of living. And the impact of these public goods and services is larger (relative to income) for lower-income households. Inequality in “final consumption” is therefore lower still than inequality in disposable income.

Government matters in reducing inequality

The importance of government programs in reducing inequality is starkly visible in this three-tiered framing. In Australia, for example, taxes and transfer payments reduce inequality by about one-third (comparing market to disposable income). And public services reduce inequality by another third (comparing final consumption to disposable income). This makes it especially important to reject calls to cut taxes (even taxes paid by working people) and the public programs that taxes fund.

Read more: Who gets what? Who pays for it? How incomes, taxes and benefits work out for Australians

In international terms, Australia’s fiscal policies do a relatively poor job of moderating inequality. This is mostly because taxes and public programs are small (relative to GDP) compared to other countries, and hence have less redistributive effect (even though Australia’s income supports are highly targeted at low-income residents).

Australia therefore ranks slightly worse in inequality in disposable income (25th out of 36 OECD countries according to the Gini coefficient) than in market income (21st). Preserving and expanding taxes and income supports – like Newstart benefits, which have languished in real terms for decades – and expanding public services over time are essential for reducing Australia’s inequality.

However, the redistributive hand of government can only do so much to moderate the inequality that the so-called “market” produces, and reproduces. Government fiscal and social policies cannot single-handedly overcome a starting point that gets worse and worse over time.

Labour market changes are driving up inequality

For most households, labour income is the most important source of private income. Two related factors are undermining labour incomes and driving up inequality.

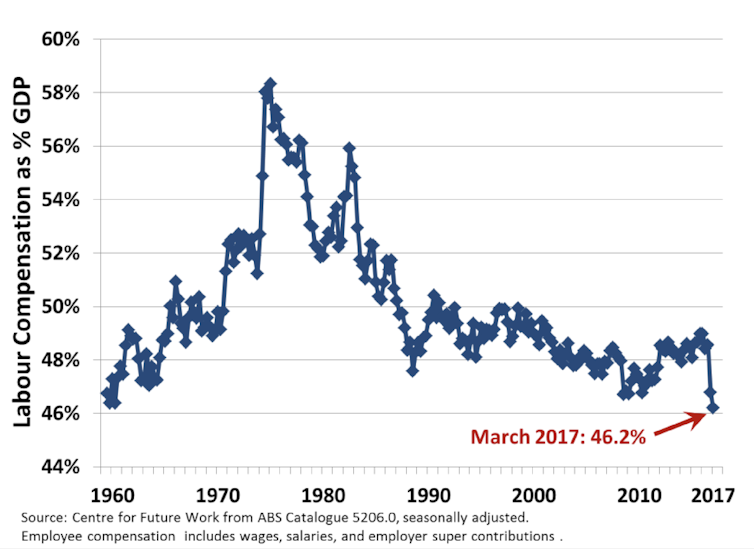

First, the share of total national income paid out in wages, salaries and superannuation has eroded dramatically since the neoliberal economic reforms of the 1980s and 1990s. Wages are barely keeping up with inflation, let alone matching labour productivity growth.

The result is a steady fall in workers’ collective share of the pie. This reached a postwar low in 2017, as shown in Figure 1.

Figure 1. Labour compensation as a share of nominal GDP.

Centre for Future Work, Author provided

Figure 1. Labour compensation as a share of nominal GDP.

Centre for Future Work, Author provided

There has been an offsetting rise in the share of income going to business owners and investors. Not surprisingly, wealthy people own the largest portion of that wealth, so redistributing income from labour to capital increases inequality.

At the same time, the distribution of a shrinking slice among workers has itself become more unequal. This also reflects the erosion of Australia’s once-vaunted labour market institutions. These were deliberately set up in the postwar era to build a more equal, inclusive society (the “fair go”). Most important in this regard have been:

The institutions that were designed to lift wages and make them more equal have been consciously dismantled. So it’s no surprise that only a shrinking minority of workers can now (thanks to particular skills or position in the economy) win wage increases of the sort most workers once took for granted. Others face low, stagnant and insecure incomes.

This transformation in the labour market has been the fundamental driver of the growing gap so visible in our communities.

So what needs to be done?

Fixing this problem requires an ambitious, multidimensional effort to rebuild the policy levers of inclusive growth. Minimum wages should be high enough that anyone working full-time can escape poverty. Supplemental measures like penalty rates and casual loading should be strengthened, not eroded. The award system should again aim to support wage growth for all workers, not just those at the bottom.

Relaxing Australia’s unique and punitive restrictions on collective bargaining and allowing workers to negotiate multi-firm or industry-wide agreements would also lift wages across the board. Instead of being vilified and persecuted, unions should be accepted and supported as an essential and constructive part of a normal labour market.

Unionists and social advocates are now forcefully prosecuting the argument to “change the rules” of Australia’s labour market. This will be one of the top issues in the run-up to the next federal election. And this debate is long overdue – because tackling inequality has to start in the labour market.

Authors: Jim Stanford, Economist and Director, Centre for Future Work, Australia Institute; Honorary Professor of Political Economy, University of Sydney

Read more http://theconversation.com/to-tackle-inequality-we-must-start-in-the-labour-market-105729