Australian small business support for Federal Government falls

- Written by Red Havas - Melbourne

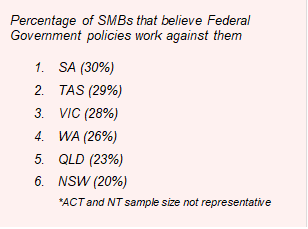

Wednesday, 20 November 2019 – The November 2019 Sensis Business Index has revealed more than one in four (26%) Australian small and medium businesses (SMBs) think current Federal Government policies are working against them – an increase of 3% from last quarter.

Sensis CEO John Allan said this is the first time the Index has seen an upward trend in the number of SMB owners who believe Federal Government policies are working against them.

“Over the years we have seen a growing perception among SMBs that Federal Government policies do not affect them. This change in sentiment may be small but is a significant trend,” he said.

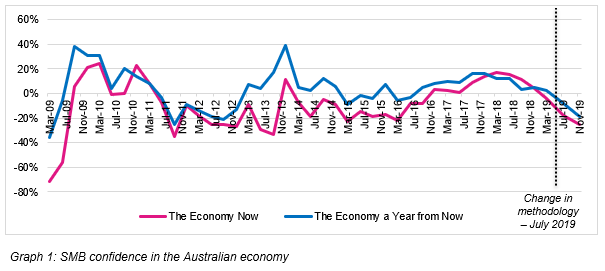

The sentiment comes as SMB confidence in the Australian economy drops 5% quarter on quarter, with 39% of SMB owners now believing the economy is in slowdown compared to 34% in the last period. Compared to the previous quarter, fewer SMB owners now believe the economy is growing (3% drop to 13%).

Thirty six percent of SMBs also believe the nation’s economy will be worse in 12 months’ time, compared to 30% last quarter. Only 16% said it would be better a year from now, compared to 22% last quarter.

This quarter’s results continue a clear downward trend in SMB economic confidence since March 2018 (see Graph 1 below).

SMB support for Federal Government

The national drop in support for Federal Government policies is led by South Australian (30%), Tasmanian (29%) and Victorian (28%) SMBs.

Conversely, support from Queensland SMBs has seen the most positive change, growing 5% from last quarter to 36%. Positive sentiment across all other states held steady quarter on quarter except for Western Australia which dropped by 5%.

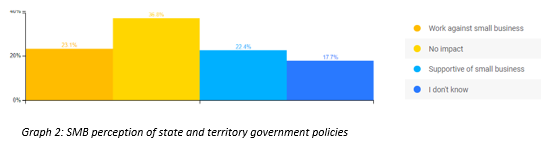

At a state and territory level, the majority (37%) of small businesses think their state government policies have no impact.

Mr Allan said this showed that a significant proportion of small business owners believe their state and territory government policies could be more effective.

“Whether this belief is right or wrong, the figures show a clear need for improvement in how state and territory governments are engaging with the small business community and communicating their efforts to support local small business owners through policy,” he said.

Access to finance increasingly difficult

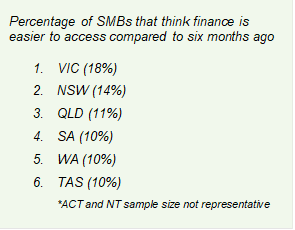

SMB owners also believe it has become harder to access finance, with 35% saying it is now more difficult – a 5% increase from the previous period.

Western Australian (42%) and South Australian (41%) SMBs are the most likely to say that finance is more difficult to access than six months ago.

Conversely, SMB owners in Victoria (18%) are most likely to think finance is now easier to access, with NSW coming second (14%).

“Small businesses nationally are facing a worsening credit squeeze as banks continue to react to the intense scrutiny and criticism of the Royal Commission. Lenders are becoming increasingly risk averse and introducing more onerous checks on borrowers, which means SMBs are being unfairly caught in the fallout from disciplinary action on the banks,” said Mr Allan.

Nationally, 17% of SMBs tried to access finance in the past six months – a jump of 5% compared to last quarter.

Of these, only 63% were successful compared to 73% in the previous period. More than one in four (26%) were rejected, compared to a rejection rate of fewer than one in five (19%) last quarter.

Bank loans remain the preferred finance option for small businesses nationally, holding steady at 39% quarter on quarter. Interestingly, consideration of equity capital raising for finance saw a rise of 3% from last quarter to 15%.

Most SMBs still confident in prospects, but slipping post-election

The majority of SMBs (55%) are still confident about their business prospects over the next 12 months despite this measure of confidence falling every quarter in 2019. This period saw the trend continue with a 2% drop in confidence compared to last quarter.

SMBs are anticipating strong profitability and workforce growth in the next three months, with 34% expecting an increase in profitability (29% in previous period) and 19% expecting the size of their workforce to grow (16% in previous period).

“SMB owners are by nature optimistic. We know they have can-do attitudes that give them the drive to tackle a challenge even in the face of trying conditions. It’s this same entrepreneurial spirit that is now shoring up SMB confidence in business prospects despite their growing scepticism in the state of the national economy,” said Mr Allan.

Forty two percent of SMBs nationally expect to grow moderately over the next year.

More than half of SMB owners (53%) believe the recent Reserve Bank of Australia interest rate cuts will have little impact on their business. However, almost one in five (19%) SMBs think the rate cuts will encourage consumers to spend more. Fifteen percent believe it will lower the cost of doing business.

Export no exception to current trends

SMBs that export goods and services say they have been exporting less in the last three months and that it has become more difficult to export in this period.

Reflecting on the last quarter, more SMB owners have seen a decrease (23%) in the amount of goods exported, than an increase (18%).

Seven percent of SMBs believe that it has become more difficult to export goods out of Australia over the last three months.

“Global growth continues to be sluggish, particularly as China’s trade war with the US has slowed Chinese growth and this in turn has delivered a blow to the global economy. Unfortunately, we’re now starting to see the trickledown effects of this among Australian SMBs,” said Mr Allan.